unified estate and gift tax credit 2021

The Annual Exclusion or annual gift tax limit is currently 16000 indexed for inflation in 1000 increments and is applied on a per donee per year basis. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

Warshaw Burstein Llp 2022 Trust And Estates Updates

This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift.

. For US citizens and residents a unified estate and gift tax is imposed generally based on the net. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002. What Is the Unified Tax Credit Amount for 2021.

The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021. The unified tax credit changes regularly depending on. What Is Unified Credit for 2021.

In other words in. Fortunately the estate tax credit creates an amount you can pass on to your heirs without being taxed. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure.

The IRS announced new. The unified aspect of this tax credit is that gift and estate taxes are rolled into one system to reduce your overall tax bill. Unified Tax Credit What is the Unified Tax Credit and Why You Should from.

No California estate tax means you get to keep more of your inheritance. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. 15000 per person per person.

Annual Exclusion for Gifts. Small Business and Self-Employed Estate and Gift Taxes Estate and Gift Taxes Estate Tax The estate tax is a tax on your right to transfer property at your death. What Is the Unified Tax Credit Amount for 2022.

Any tax due is. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

5 You can give up to this amount in money or property to any individual per. Or of course you can use the unified tax credit to do a little bit of both. What is the unified tax credit amount for 2021.

Effective January 1 2005 the state. Tax generally is imposed by the local governments at various rates. California does not levy a gift tax.

However the federal gift tax does still apply to residents of California. The gift and estate tax. As of 2021 you are able to give 15000 per year to any individual as a tax-exempt gift.

This means that you can give 15000 every year to each of your 10 children. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021. For 2021 that lifetime exemption amount is 117 million.

Most relatively simple estates cash publicly traded securities small. As of 2021 you are able to give 15000 per year to any.

Planning For Year End Gifts With The Gift Tax Annual Exclusion Timpe Cpas

The Future Of The Unified Tax Credit And Potential Strategies Cba S Thebar

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

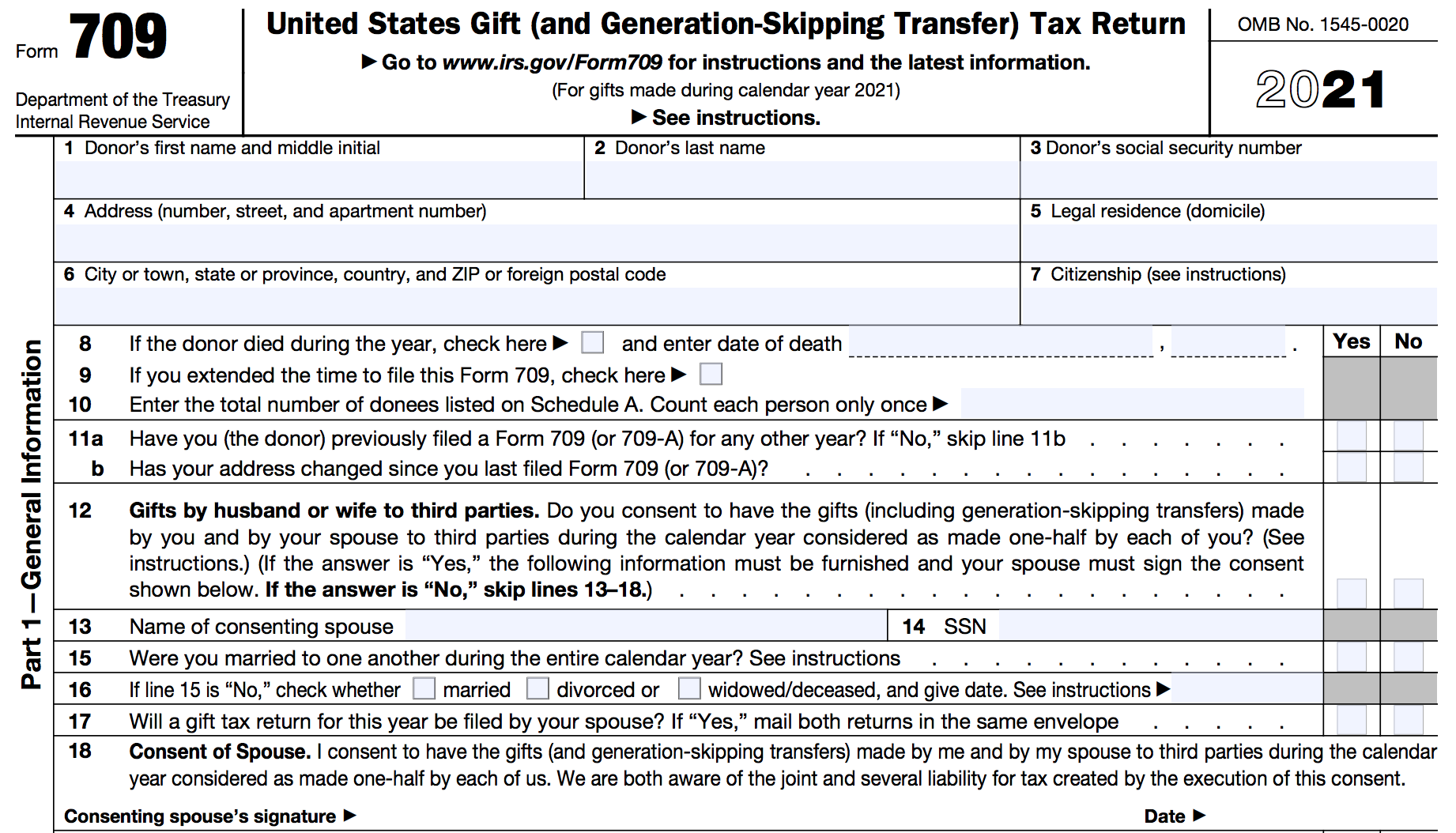

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

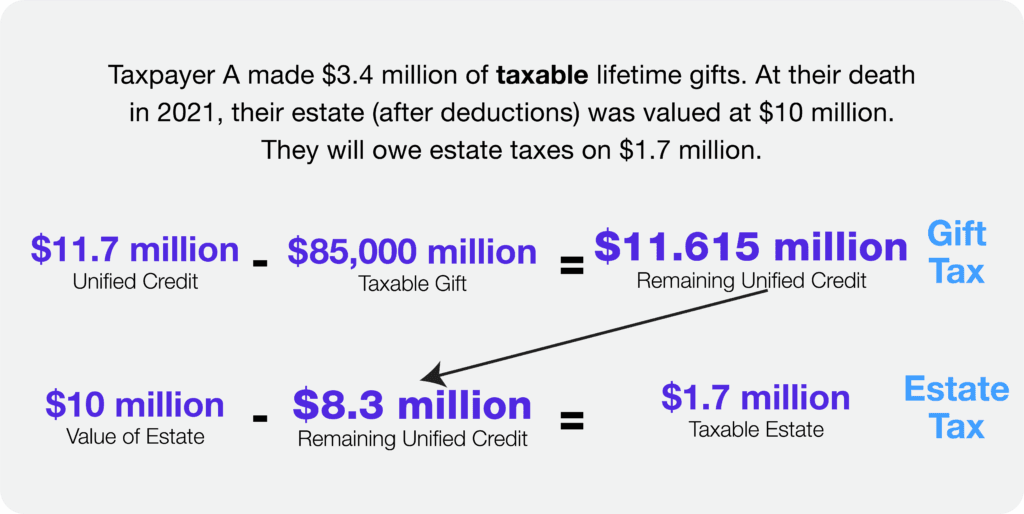

Understanding How The Unified Credit Works Smartasset

Planning For Year End Gifts With The Gift Tax Annual Exclusion Doeren Mayhew Cpas

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

The Estate Tax And Lifetime Gifting Charles Schwab

Planning For Year End Gifts With The Gift Tax Annual Exclusion Somerset Cpas And Advisors

Opinion Favorable Federal Gift And Estate Tax Rates Probably Won T Last Forever Here S What To Do To Prepare Marketwatch

Beware The Generation Skipping Transfer Tax

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Navigating The Changes To Tax Laws In 2021 University Of Cincinnati

Talk To Clients About Estate Taxes Lifetime Gifts Corvee

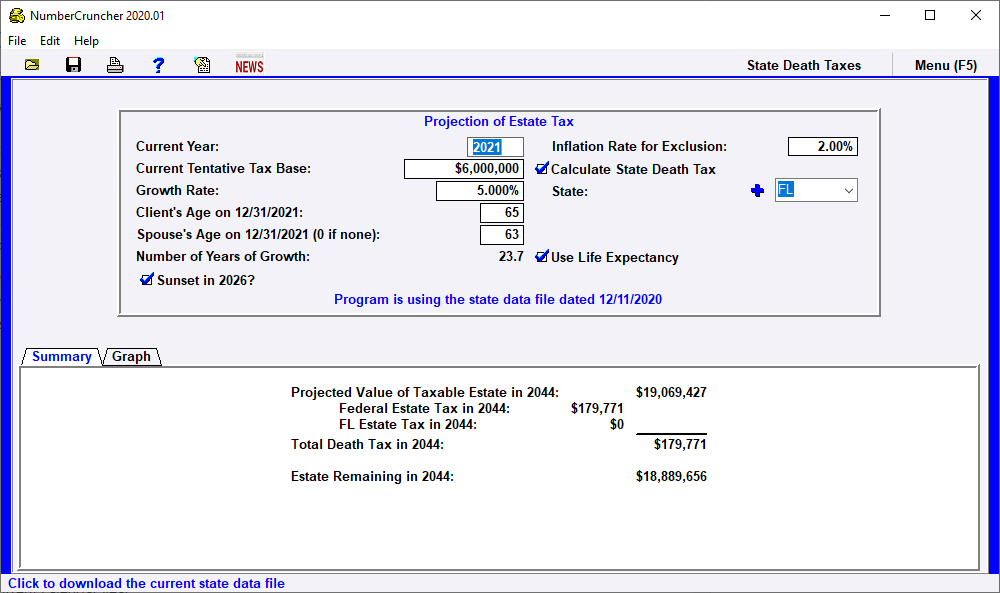

Project Projection Of Estate Tax Leimberg Leclair Lackner Inc

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Unified Tax Credit What Is The Unified Tax Credit And Why You Should Care Waldron Schneider

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj